FinTech 101: Understanding the Basics

A Simple Definition of FinTech

The term “fintech company” describes any business that uses technology to modify, enhance, or automate financial services for businesses or consumers. Some examples include mobile banking, peer-to-peer payment services (e.g., Venmo, CashApp), automated portfolio managers (e.g., Wealthfront, Betterment), or trading platforms such as Robinhood. It can also apply to the development and trading of cryptocurrencies (e.g., Bitcoin, Dogecoin, Ether).

A Brief History of FinTech

While fintech seems like a recent series of technological breakthroughs, the basic concept has existed for some time. Early credit cards in the 1950s generally represent the first fintech products available to the public, in that they eliminated the need for consumers to carry physical currency in their day-to-day lives. From there, fintech evolved to include bank mainframes and online stock trading services. In 1998, PayPal was founded, representing one of the first fintech companies to operate primarily on the internet — a breakthrough that has been further revolutionized by mobile technology, social media, and data encryption. This fintech revolution has led to the mobile payment apps, blockchain networks, and social media-housed payment options we regularly use today.

How Does FinTech Work?

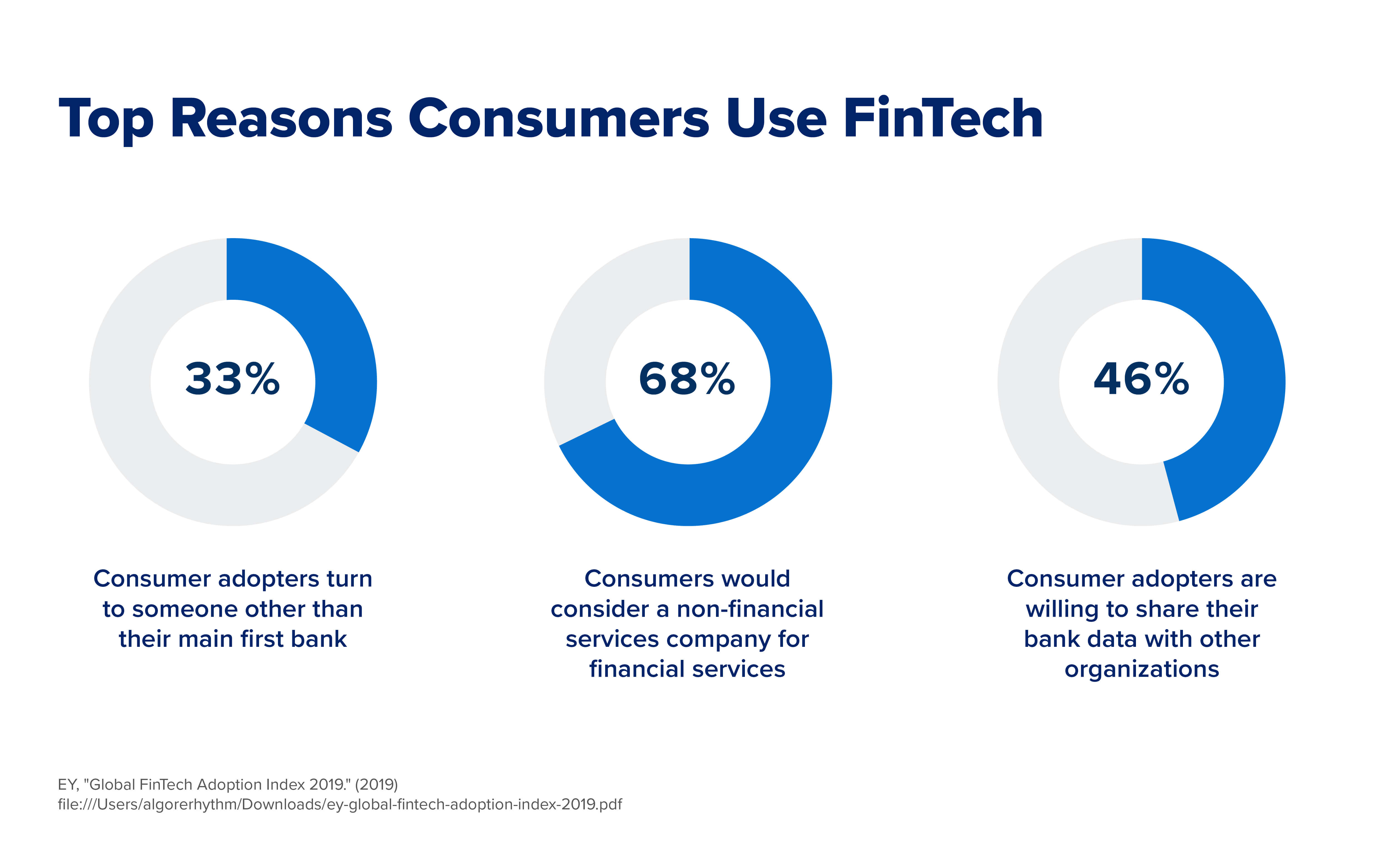

While fintech is a multifaceted concept, it’s possible to gain a strong understanding. FinTech simplifies financial transactions for consumers or businesses, making them more accessible and generally more affordable. It can also apply to companies and services utilizing AI, big data, and encrypted blockchain technology to facilitate highly secure transactions amongst an internal network.

Broadly speaking, fintech strives to streamline the transaction process, eliminating potentially unnecessary steps for all involved parties. For example, a mobile service like Venmo or CashApp allows you to pay other people at any time of day, sending funds directly to their desired bank account. However, if you paid instead with cash or a check, the recipient would have to make a trip to the bank to deposit the money.

Live Chat

Live Chat