Traditional Degrees

College remains a go-to path for those entering finance, particularly learners just beginning their education. And quantitative analysis is a popular major for learners who want to merge their passions for finance and technology.

Quantitative analysts (or “Quants”) put their mathematical, statistical, and programming skills to use for banks, investment firms, wealth managers, and insurance companies. They can pursue degrees in economics or finance but also might consider engineering, computer science, or other degrees that emphasize mathematical training. Eighty-five percent of quantitative analysts have a college degree, according to CareerOneStop, and 37 percent hold a Master’s degree or higher.

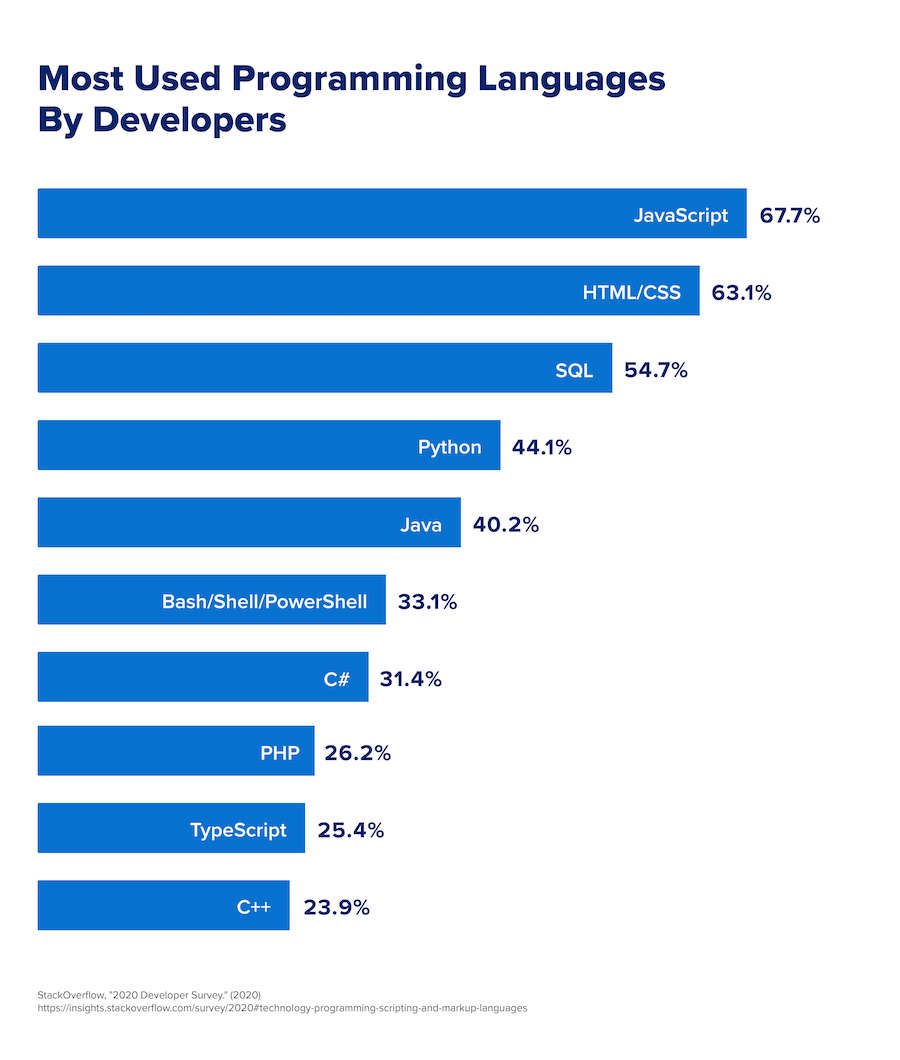

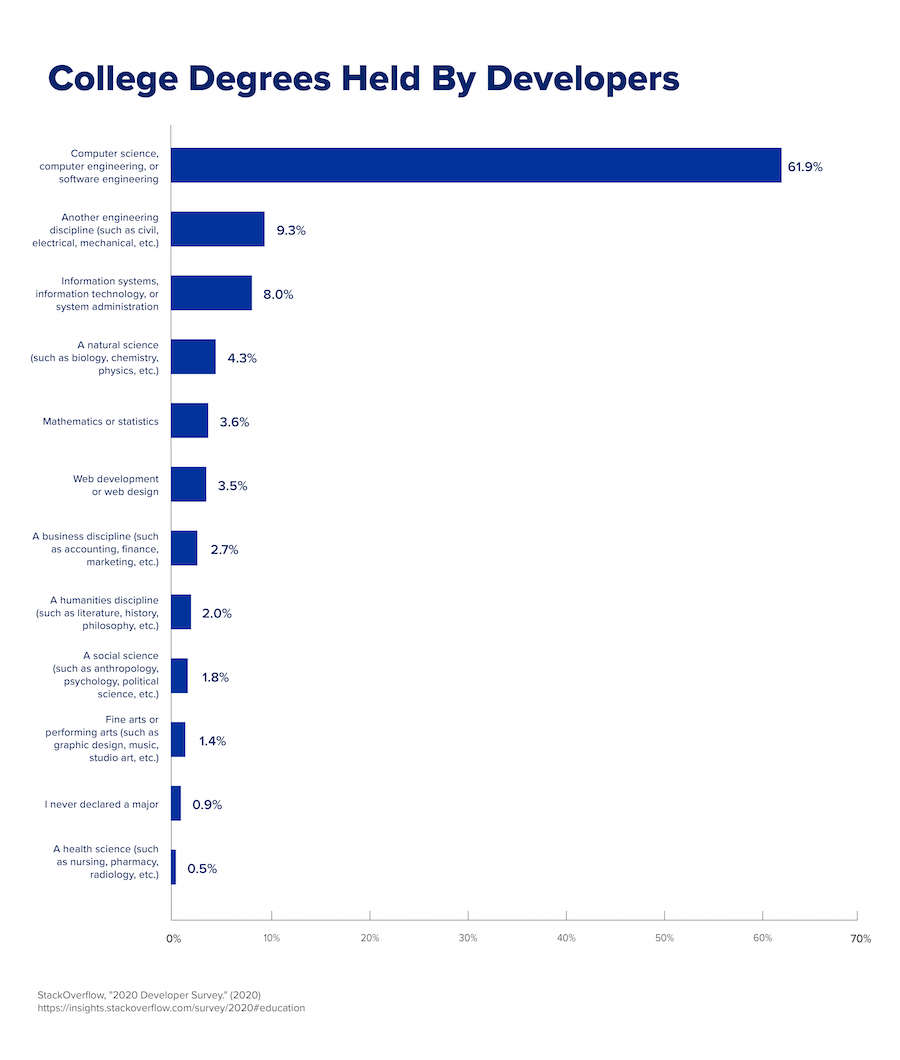

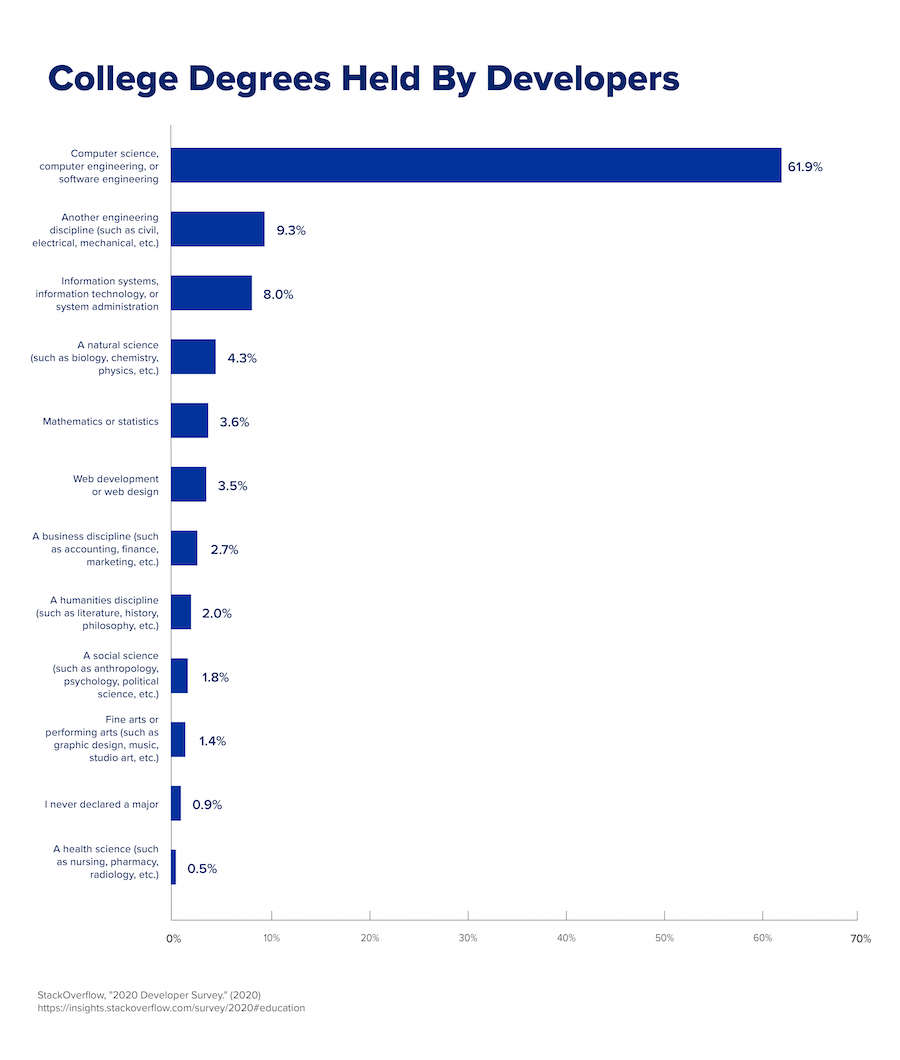

College degrees continue to carry value in tech fields, with nearly 62 percent of developers holding a degree in computer science, computer engineering, or software engineering, according to Stack Overflow. And how popular is Python in college computer science departments? This list of worldwide schools that teach Python underscores the language’s demand on campus.

Independent Learning Options

Looking to learn solo? You’re not alone. About 16 percent of developers in the 2020 Stack Overflow survey favored forgoing a formal education.

Books, videos, and online tutorials abound for those who want to learn Python, Java, C++, or any programming language valuable to finance and fintech. Python and Java, for instance, offer resources to help learners get started. Several educational communities provide self-paced, low- or no-cost learning opportunities that coding newcomers or career transitioners can apply to several financial fields. And professional sites such as LinkedIn have built courses covering Python and other financial programming skills.

Independent learning can work for motivated self-starters who relish a challenge and know what they want to learn. For those who need more structure or a broader approach, college might be the better option. Meanwhile, learners with the drive to succeed and desire to focus on the essential programming skills for finance could consider a bootcamp. The choice is yours, so get programming.

For more information, check out Columbia Engineering Boot Camps.

Live Chat

Live Chat