5 of the Top FinTech Careers

In modern commerce, cash — literal coins and bills, that is — is no longer king. Today, shoppers tend toward more future-forward transactions; rather than swap bills at a register, they swipe cards, tap-to-pay, and send money via app. Few people prefer in-person transactions when they can handle their savings, investments, and “I’ll pay you back tomorrow”s via smartphone.

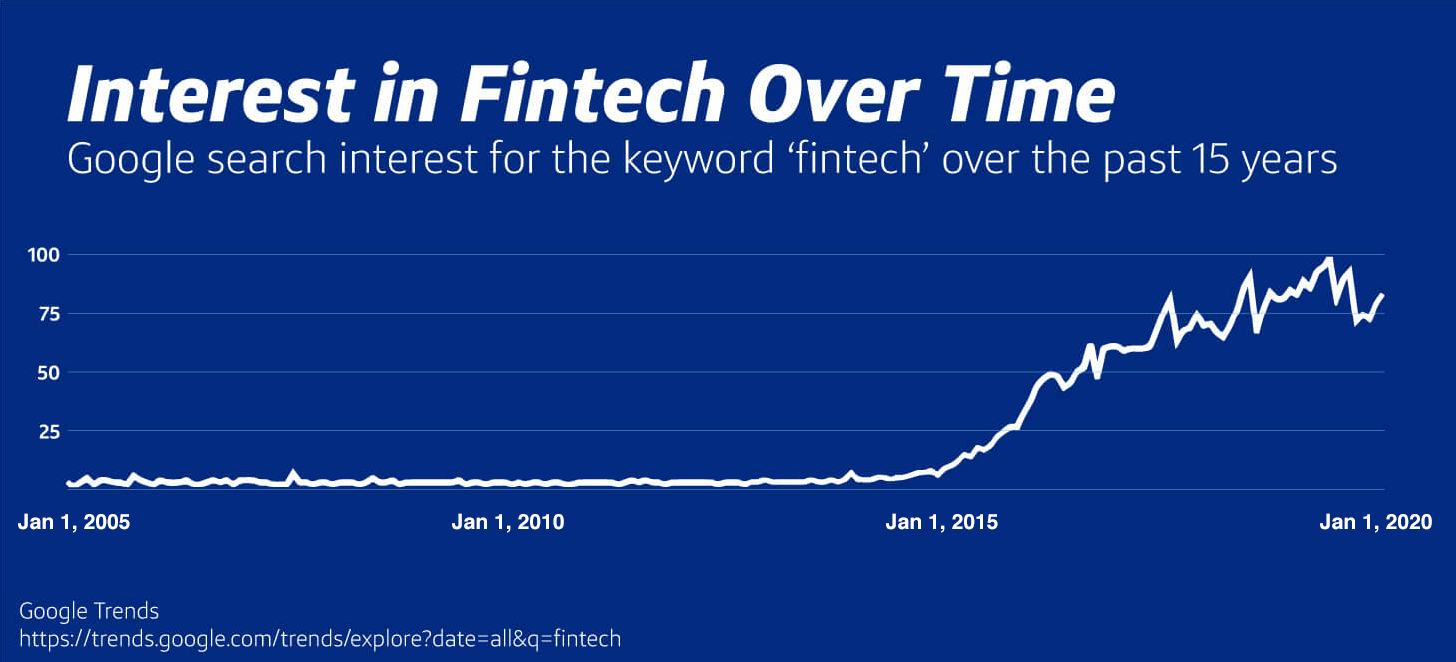

Given this, it’s probably not surprising that fintech — and a career in fintech — is all the rage. While Google Trends reports that the term was almost unsearched in 2011, by 2020 its popularity was upwards of a 90-point rating on Trends’s 100-point popularity scale.

Financial technology, or fintech, refers to any technology that streamlines the delivery of financial services. It can help business owners, corporate entities, and even everyday consumers automate the way they interact with the financial world.

But fintech isn’t confined to the back end of financial systems or limited to in-the-know financial professionals — quite the opposite! Today, financial technology is an inextricable and often consumer-facing part of industries such as retail, banking, education, fundraising, investment management, and nonprofit work.

Unsurprisingly, the growth of the fintech industry has paralleled — even exceeded — its interest as a Google search query. A 2020 report from Research and Markets found that the global fintech market is expected to grow at a compound annual growth rate (CAGR) of around 20 percent between 2020 to 2025, reaching a whopping $305 billion in value by the end of that period.

Earlier this year, CB Insight’s annual report further noted that fintech startups raised nearly $108 billion worldwide in 2019 alone.

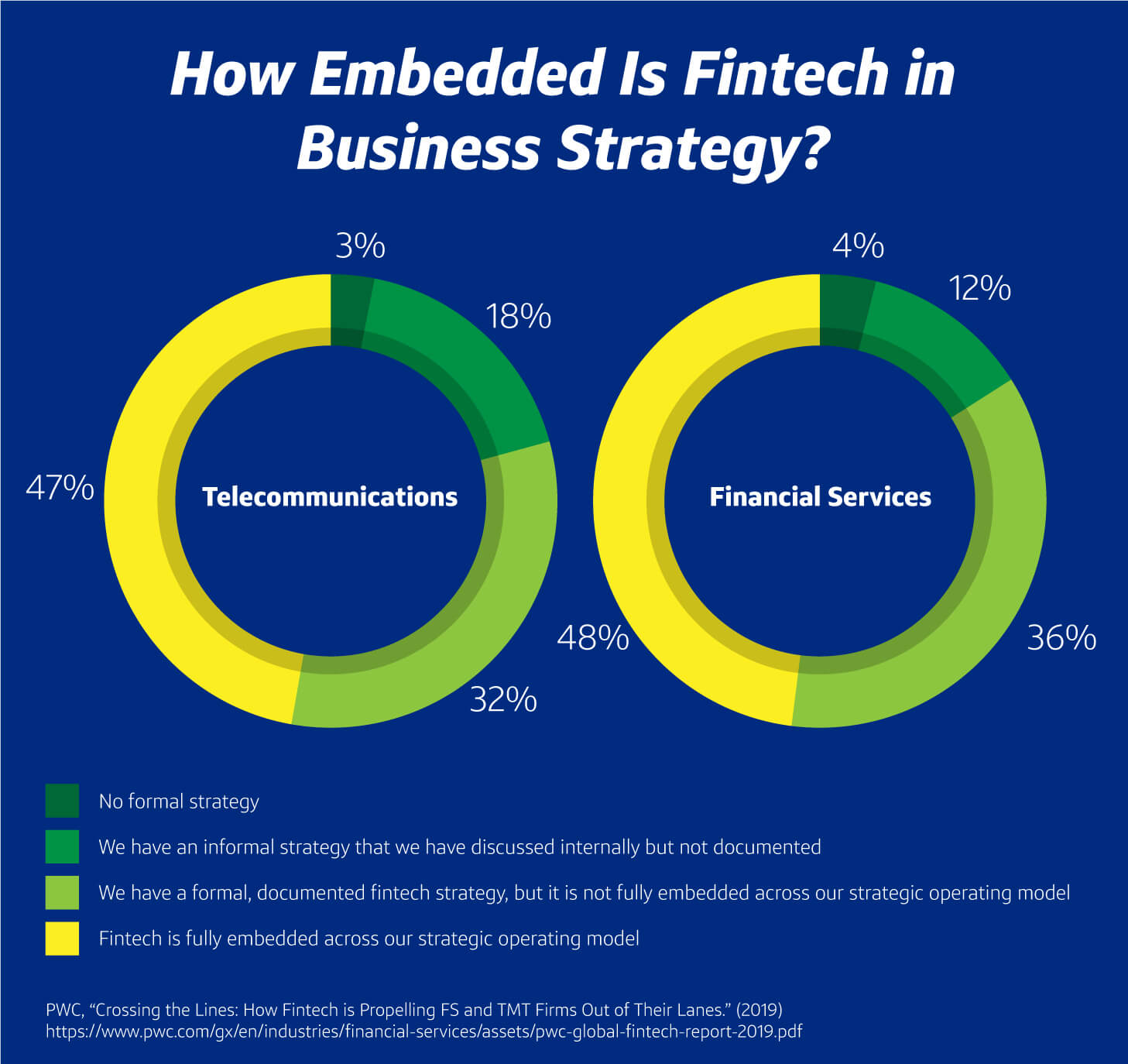

Corporate investment, too, is significant. In 2019, researchers for PwC’s Global Fintech Report found that 48 percent of financial services organizations and 48 percent of technology, media, and telecommunications companies have “embedded fintech fully into their strategic operating model.”

More significantly for aspiring fintech professionals, that same study found that 80 percent of telecommunications organizations and 75 percent of financial services companies are creating jobs relating to fintech. However, reportedly, 42 percent of both categories are struggling to fill their growing need for talent.

Today, these professionals can also find work with smaller, disruptive companies that seek to challenge traditional financial offerings by automating clunky services, increasing service accessibility, and removing bureaucracy and overhead. Every day, fintech professionals race to create products that run the gamut from budgeting apps to mobile investment portfolios and automated payment software.

This uptick in interest and investment has led to significant opportunities for those who want to build careers in fintech. Want to know where your interest in fintech might take you? We’ll walk you through a list of the most popular (and unexpected) fintech careers of 2020.

These FinTech Careers Are on the Rise

There is no shortage of meaningful careers in fintech. As you peruse the list, make sure to note which fields spark your interest.

Blockchain Developer

You’ve probably heard the term “blockchain” in conversation a few dozen times — but do you know what it actually means?

Put simply, blockchain refers to a chain of digital blocks, where information (a block) is stored in a public database (a chain). A blockchain is a public ledger where information about users’ transactions is kept. A single block stores information about thousands of transactions, like the date, time, amount, and anonymous digital signatures associated with a purchase.

Though blockchain was initially developed for the decentralized currency Bitcoin, it has since been applied to various industries within and beyond the tech sector.

As a blockchain developer, you would be responsible for creating a blockchain architecture, setting up payment processing, designing user interfaces, and implementing security measures to protect customer information against cyberattacks.

Blockchain developers usually have a sturdy foundation of technical skills that includes but is not limited to:

- Computer networking

- Cryptography

- Algorithms and data structures

- Knowledge of one specific type of blockchain, like Bitcoin

- Ability to research and emulate existing blockchain architectures

Learn More About Blockchain Development

- How to Become a Blockchain Developer (Block Geeks) — This instructional guide shows how to become a full-fledged blockchain developer, touching on the primary development tools, frameworks, and performance metrics used by industry professionals.

- Mastering Bitcoin: Unlocking Digital Cryptocurrencies (Andreas M. Antonopoulos) — In this book, Antonopoulos covers all the Bitcoin basics, teaching readers how to “unlock the API to a new economy.” From crafting wallets that automate cafe purchases to running an off-the-grid e-commerce platform, this book runs through the basics of cryptography, network protocols, and mining.

- Concepts 101 Series (CryptoBasics Podcast) — The CryptoBasics podcast gives newcomers the information they need to create safe passwords, implement password managers, and protect against malicious attacks. This 101 series covers several topics relevant to fintech, including security, investment theories and strategies, and use cases for blockchain.

Crowdfunding Specialist

Crowdfunding dates back to the late nineties, when one British rock group, Marillion, couldn’t front the $60,000 it needed to launch a reunion tour. After the band requested support from its fan mailing list, one developer volunteered to aggregate the donations necessary to fund the trip.

In the decades since then, crowdfunding has emerged as one of the primary ways that small causes, creatives, and individuals raise money for projects. Now, giants like Indiegogo, Kickstarter, and GoFundMe dominate the industry — and offer opportunities for fintech career advancement.

Today, fintech-savvy crowdfunding specialists work to craft crowdfunding platforms, widgets, and campaigns. These developers may, among other responsibilities, interface directly with clients, conduct research, and identify target audiences for crowdfunding campaigns.

Crowdfunding specialists need to be capable communicators, as they often take a leading role in curating digital marketing and social media campaigns. Specialists may also need to build trust with potential donors, manage an entire funding campaign, and identify underutilized avenues for receiving micro-donations. The role might further require copywriting material for social media and increasing donors’ awareness of the brand.

These professionals can come from educational backgrounds as varied as computer science, communications, marketing, finance, or economics. Many specialists are drawn from industries they’ve worked in — for instance, it’s not uncommon for a former volunteer to eventually take responsibility for managing a nonprofit’s crowdfunding strategy.

Specialists will need the following skills to succeed at work:

- The ability to establish crowdfunding campaigns based on market research

- The ability to communicate with potential donors, company stakeholders, and other donation sources

- Strong communication ability with an organization’s project managers, marketers, and other departments

- Verbal and written skills with an interest in storytelling

- Commitment to the company’s core mission and principles

- Proficiency in graphic design, Microsoft Office, or proprietary software

Learn More About Crowdfunding

- Crowdfunding 101 (Crowdfunding Strategy) — We suggest reading this short guide to crowdfunding, which outlines the essential tips and platforms that can be used to curate a successful campaign.

- Crowdfunding Basics in 30 Minutes (Michael J. Epstein) — In this book, Epstein explains how to plan and execute a killer crowdfunding campaign. In one sitting, you’ll learn about what platform you should use, how to build a following, and the best practices for tiered rewards programs.

- Meet The Crowdfunding Consultants: ‘We Live or Die by Success’ (The Guardian) — This article profiles crowdfunding professionals and provides a few key insights into what it could be like to work in the field.

Quantitative Analyst

Are you a numbers person? If so, a more intensely analytical role might be right for you. Quantitative analysts, more succinctly known as “quants,” are professionals who develop the mathematical models that price financial securities, reduce investment risk, and generate avenues for profit.

Quants design complex models that empower financial firms to price and trade securities. These analysts are often employed by investment banks, commercial banks, insurance companies, consultancies, and hedge funds.

Quants can work in either back end or client-facing roles. In the “back office,” quants validate models and create new trading strategies that can be employed by financial advisors. Front office quants work directly with traders, providing them with pricing and trading tools.

Currently, quants are in high demand. This talent crunch is the result of several factors, including an uptick in hedge funds, the development of automated trading systems, and the increasing complexity of financial securities.

Most quantitative analysts enter the field after achieving a Master’s degree or doctorate. Job candidates are required to have experience conducting independent research and designing fully-fledged quantitative models.

Quants are required to have a wide range of skills, including:

- Expertise in mathematical modeling and statistics

- Knowledge of programming languages like Python, SQL, C#, Java, .NET, and VBA

- Experience with analysis software packages like Matlab, R, S-Plus, Excel, and SAS

- Excellent verbal and written communication skills

- Ability to document and present results to company owners, stakeholders, and clients

Learn More About Quantitative Analysis

- Quantitative Finance For Dummies (Steve Bell) — Providing a thorough explanation of quantitative finance, Bell offers a plain-English guide to applying mathematical models to decision-making. After reading the book, you’ll understand the options and risks, foundational equations, formulas, and modeling software that underlie quantitative finance.

- An Introduction to Quantitative Finance (Stephen Blynth) — Blynth’s introduction to quantitative financial analysis provides a comprehensive theoretical background to real-world trading. The book outlines key tools for analyzing, valuing derivatives, and quantifying financial transactions. Keep in mind that this introduction is meant for those who’ve mastered the material of an undergraduate course in probability.

- The Curious Quant Podcast (The Curious Quant) — Hosted by finance expert Michael Kollo, the Curious Quant podcast facilitates discussions between tech professionals and financial advisors. It also examines the use of statistical methodologies in resolving problems that plague financial markets.

Risk and Compliance Expert

Compliance experts are responsible for ensuring that a company adheres to internal policies and external regulations on financial trading. In this role, an expert ensures that various departments protect investors, provide fair access to markets, and operate transparently.

Without compliance experts, businesses would suffer from high system risk and could unwittingly commit financial crime. Risk-reduction experts seek to increase consumer confidence in the financial system, ensuring that the organization is aware of complex business rules that govern customer communication, conflicts of interest, client assets, and common lending pitfalls.

After the 2008 financial crisis, increased regulatory scrutiny created a challenging environment for companies to navigate. Instead of taking on a mere “advisory” role, risk compliance professionals are now actively involved in mitigating risk.

In recent years, businesses have turned to RegTech to automate compliance concerns. RegTech is a broad term that refers to regulatory processes managed through the application of technology.

RegTech is most often employed by financial institutions that offer SaaS (Software as a Service), helping client-facing institutions cut down on their overhead as they adhere to regulations. The recent rise in cyber hacks, data breaches, and fraudulent digital activity has necessitated the development of RegTech.

Fintech-savvy compliance specialists may help implement and maintain RegTech frameworks for businesses, making it simpler for companies to adhere to regulations. Specialists may also take on a more analytical role by monitoring the prevalence of regulation-breaking behavior, monitoring transactions in real-time, and identifying issues as they occur.

Compliance specialists are often required to hold a Master’s degree or equivalent in finance, business, or economics. Relevant experience in ethics, organizational business, statistical analysis, and law is also beneficial.

Compliance specialists will need a variety of skills, including:

- The ability to audit organizational compliance through tech solutions

- Experience with resolving compliance issues while adhering to outlined company policy

- The ability to stay up-to-date with changes in regulatory policy internal and external to the organization

- Interview and investigation skills

- The ability to interface with clients, company stakeholders, and legal institutions

Learn More About Compliance

- Compliance 101: The Basics of Compliance and How It Affects You (Learning Hub) — Becoming a compliance expert doesn’t make you a “stickler” for the rules; it’s a discipline actively dedicated to saving businesses and livelihoods. This instructional guide outlines what compliance means, how companies adhere to it, and the growing presence of technological solutions in the field.

- How Fintech is Changing the Compliance Landscape (ACAMS Today) — In the last few years, startups and innovative products have disrupted traditional financial products. As consumers ask for new ways to save, spend, and borrow money, it falls on compliance experts to apply flexible solutions. This article outlines how compliance experts have identified gaps in consumer protection and created data security solutions.

- A Guide to Financial Regulation for Fintech Entrepreneurs (Stefan Loesch) — In this book, Loesch explores how risk experts address regulation in modern financial companies, optimize companies’ time-to-market, and develop internal policy.

App Developer

In the digital age, consumers seek new ways to save, invest, and keep tabs on their accounts. Few people in this digital era want to take the time to physically visit a bank branch; many instead rely on mobile banking apps and investment sites. Today, consumers can complete peer-to-peer transfers and budget almost entirely online.

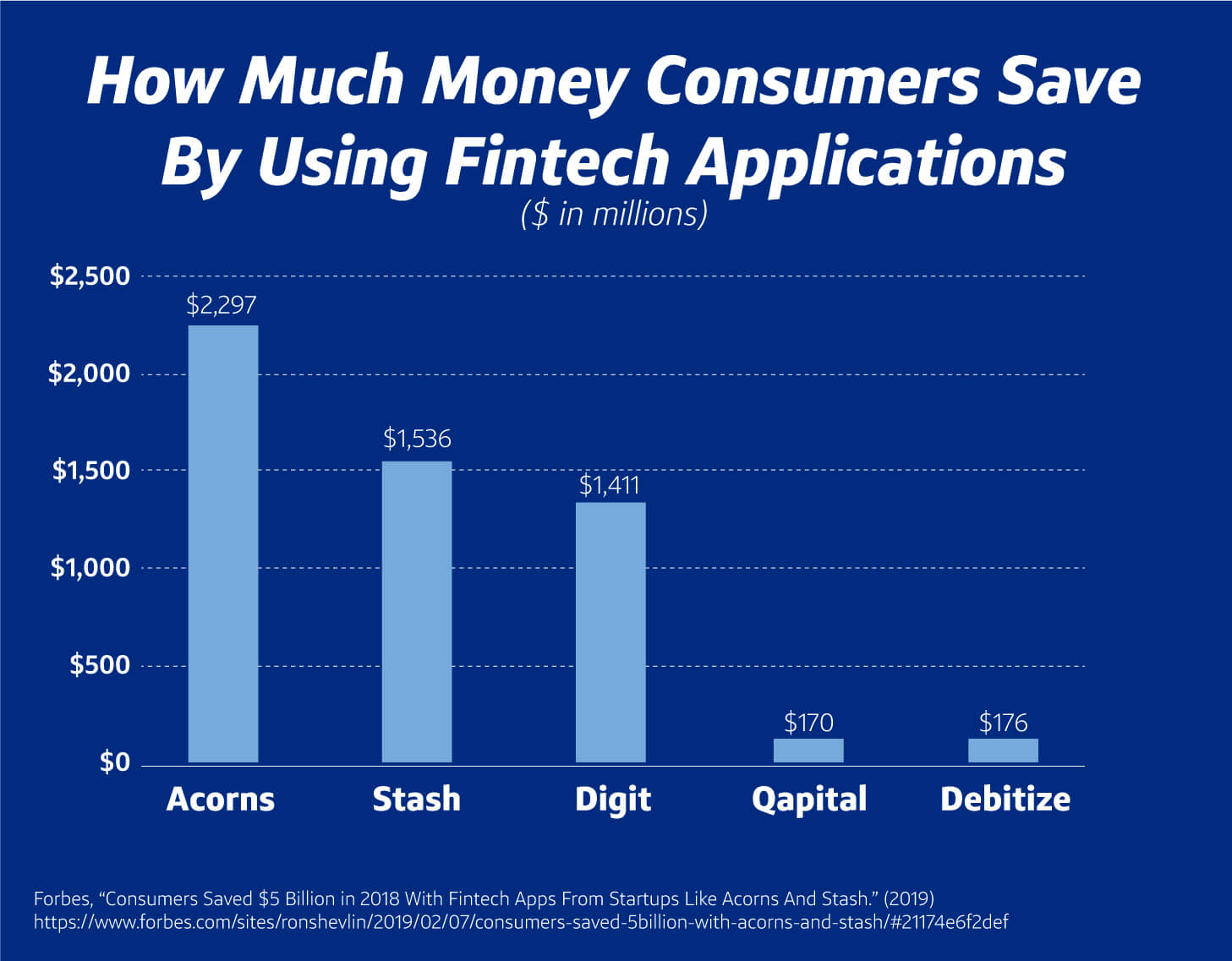

In 2018 alone, consumers saved $5 billion through startup applications like Acorn and Stash. Across the seven most prevalent neobanks, American consumers opened 3.25 million accounts and siphoned $1.68 billion into these portfolios. Traditional institutions like Chase and Wells Fargo have been forced to adapt to the modern landscape by developing apps that target younger, tech-savvy consumers.

The increasing popularity of retail banking apps has led to an increased call for fintech app developers. At the most basic level, these developers seek to improve the relationship between consumers and their financial lives, creating tools that make it simpler to save. They strive to integrate social media APIs, develop streamlined applications, and automate essential financial services.

While responsibilities differ widely depending on the job posting, fintech developers usually program client-facing tools for startups or traditional institutions. Some developers may also develop analytics tools using machine learning.

App developers may need to have a working knowledge of the following:

- AI, neural networks, and other machine learning capabilities

- Experience with agile software development in a UNIX/Linux OS environment

- Knowledge of algorithms, data structures, object-oriented programming, and cryptography

- Experience with databases like MongoDB and Apache Cassandra, in addition to data processing systems like Hadoop

- Ability to program in languages like C++, C#, Java, and Python

Learn More About App Development

- Android Programming: The Big Nerd Ranch Guide (Kristin Marsicano) — Marsicano’s book guides readers through the key concepts, terms, APIs, and technologies associated with fintech app development. The guide is heavily hands-on and encourages learners to write and run functional code during every lesson.

- Founders Talk Podcast (Founders Talk) — Hosted by Adam Stacoviak, the Founders Talk podcast invites startup founders, CEOs, and creatives for in-depth conversations concerning app development. The podcast touches on topics such as how to quit an enterprise at the right time and the basics of founding your own company.

- How to Become a Mobile App Developer: A Complete Newbie Guide (BuildFire) — Geared toward newcomers, this guide teaches readers how to dive head-first into app development and build a project worth using. It will lead you through the leading educational platforms, low-cost ways to start developing, and the cycle of app development.

Final Thoughts

Fintech is a burgeoning field that has gained increasing recognition from established financial companies, disruptive startups, and end-users alike. Devoted to optimizing the way that consumers interact with their financial life, fintech now plays an increasingly significant role in our digital lives.

So, are you interested in landing a job in one of the above roles? Take the first step toward launching a meaningful fintech career by exploring your educational opportunities: you can prepare yourself by enrolling in a college degree program, boot camp, or self-guided online course.

If you have yet to achieve a degree, an undergraduate degree program in computer science, economics, or business management could be beneficial. College degree programs not only give you the opportunity to network with industry professionals, they also give you the time and means to develop a fleshed-out portfolio.

Of course, college may not be for everyone — it requires an investment of time and money. Many people instead turn to boot camps, which are intensive, short-term training courses that equip you with industry-ready skills in three to six months.

If a structured course isn’t your thing, we suggest relying on online tutorials, self-guided courses, and books to achieve the training you need. Though this route is the most flexible and cost-effective option of the three, you’ll need to do the heavy lifting of crafting a curriculum and building a standout portfolio that will impress employers.

Review your educational opportunities and pick the path that’s right for you. If you’re interested in a career in fintech, you’ll be hard-pressed to find a more satisfying and rewarding opportunity.

Live Chat

Live Chat